Best starting out card

No credit check to apply

89.4% approval rate3

Strong credit starts here

Your deposit =

Your credit line

Now this is math we can all handle. Put in $100, get $100 credit. Put in $300, get $300 credit. You decide what works for your wallet. Simple as that.

We report to all 3 major credit bureaus. That means every on-time payment is working triple shifts to build your credit.

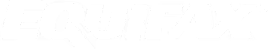

Credit goals, meet credit tools

Your credit journey shouldn't make you want to throw your phone across the room. We've built tools that keep it simple:

Your credit score will thank you

Up to 10% cash back4 where it matters: Everyday spending

That OMG moment when your FICO® Score jumps 47+ points in 6 months*

The score

lenders use

+ 47 POINTS

* On average, OpenSky users improve their credit scores by 47 points in 6 months. That’s not just a statistic - that’s your future looking up.

Why people trust opensky

Frequently asked

What is a "secured" credit card?

A secured credit card requires a one-time refundable security deposit to open and is equal to your credit limit. For example, if you deposit $100, your credit limit becomes $100. The beauty of the opensky secured credit card is that you can open an account without undergoing a traditional credit check. This is especially beneficial if you have a poor credit history or no credit history at all.

How much will a secured credit card raise my score?

Your rate of improvement depends on a few factors, including your current status, payment habits, and your management of this and any other lines of credit. Opensky is designed specifically to help people improve their credit fast, with an online/mobile app and tools like alerts to help monitor your account. Plus you will get considered for credit line increases that turbocharge your growth.

How can I obtain a copy of my credit report?

Federal law states that you can get a free report from each of the three nationwide consumer credit reporting companies - Experian®, TransUnion® and Equifax® - once every 12 months. Don't be fooled by offers from companies to pull your credit report or websites that ask for payment to see your credit report; only https://www.annualcreditreport.com/index.action is the official site authorized by the Federal government.

Is there an annual fee for this card? Are there any hidden charges?

Yes, there is a $35 annual fee for the opensky Secured Visa® Credit Card. There is no annual fee for the opensky Plus Secured Visa® Credit Card. Opensky believes in being upfront. There are no hidden fees or charges. All of our pricing and fee information is transparent and can be reviewed (See cardholder agreements at the bottom of this page).

What is a "credit limit" and how is my credit limit decided?

A credit limit represents the maximum amount you can spend on your credit card subject to approval. You decide the deposit amount, which directly determines your credit limit. It can range from as low as $100 to as high as $3,000, depending on the card you choose. The goal is to ensure you can manage payments effectively and succeed in building your credit! *All applications are subject to approval.

%201.avif)

.avif)

.avif)

.avif)

.svg)